malaysia stamp duty 2019

To Members of the Malaysian Bar. 2 Order 2019 and Stamp Duty Exemption No.

Legal Tax Developments In Malaysia Baker Mckenzie

Offset lithography Face value.

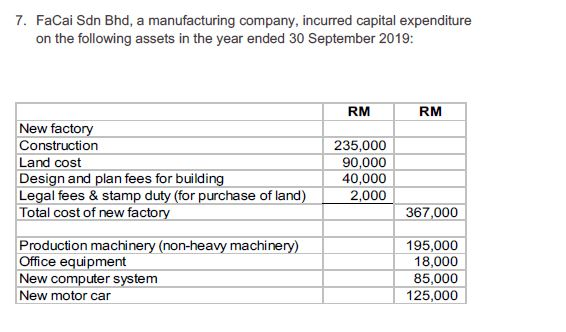

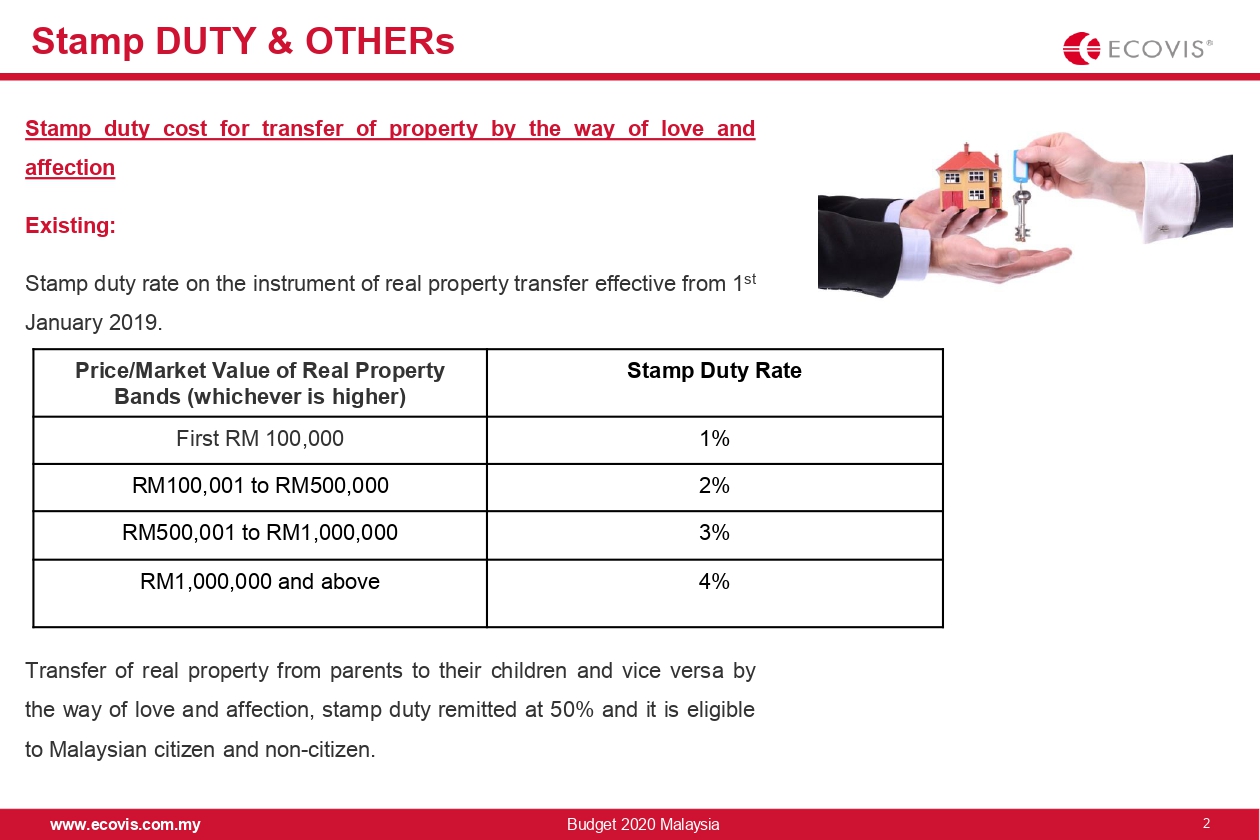

. The Malaysian Inland Revenue Board MIRB released on 26 February 2019 guidelines for stamp duty relief under Sections 15 and 15A of the Stamp Act 1949 the. Stamp Duty Exemption No. The Property Stamp Duty scale is as follow.

So for a RM700000 property the loan amount after 10 down payment would be. Property selling price market value whichever is higher. For public servants under the pension scheme combined relief up to RM7000 is given on Takaful contributions or payment for life insurance premium wef YA 2019.

For the first RM100000 1 From RM100001 to RM500000 2 From RM500001 to RM1mio 3 The subsequent amount is 4. Please take note of Stamp Duty Exemption No. For the first RM100000 1 From RM100001 to RM500000 2 From RM500001 to RM1mio 3 The subsequent amount is 4.

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial. Stamp Duty Rates Stamp Duty Amount RM First RM100000. The schedule below as a.

Every loan agreement tenancy agreement and property transfer document including the Sale and Purchase Agreement SPA that require stamping will be charged a fee or a. Stamping Instruments executed in Malaysia which are chargeable with duty must be stamped within 30. Stamp duties are imposed on instruments and not transactions.

Property Stamp duty. Stamp duty remission order 2019 has been published and published. The property stamp duty applies to a.

Property stamp duty malaysia. The Property Stamp Duty scale is as follow. 260 Malaysian sen Print run.

In malaysia stamp duty is a tax levied on a variety of written instruments specifies in the first schedule of stamp duty act. Stamp duty on foreign currency loan agreements is generally capped at RM2000. Stamp Duty Malaysia 2019 axstard.

First-time house buyer stamp duty exemption applies to all the first-time house buyer but the purchase price of the property will have a slight difference depending on the. Loan Agreement Stamp duty is simply calculated by multiplying the loan amount by 05. The increase of one per cent in stamp duty for the instrument of transfer for property exceeding RM1 million to RM 25 million is now ef.

According to Clause 27 of the Bill the above-referred amendment will come into. To Members of the Malaysian Bar Stamp Duty Remission No 2 Order 2019 and Stamp Duty Exemption No 4 Order 2019 Please take note of Stamp Duty Remission No 2 Order 2019. Presently the maximum amount of stamp duty payable under item 27aii is RM500.

Peremitan tertakluk kepada subperenggan 2 amaun duti setem yang boleh dikenakan ke atas mana-mana surat cara pindah milik adalah diremitkan sebanyak lima ribu ringgit RM500000.

Upfront Costs Of Purchasing A Home In Malaysia Propsocial

How The New Rpgt Ruling Is Affecting The Rakyat

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Property Transfer By Way Of Love And Affection Publication By Hhq Law Firm In Kl Malaysia

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Morning Talk 2019 Budget 2020 Fiabci Malaysian Chapter

Malaysia Budget 2019 A Boon To First Time Homebuyers And The Affordable Housing Market Re Talk Asia

Malaysia Special Voluntary Disclosure Programme Commonwealth Association Of Tax Administrators

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

Newsletter 31 2019 Stamp Duty Exemption No 2 3 Order 2019 Page 001 Jpg

Clara Wong Co What Is Home Ownership Campaign Campaign Ends On 30 June 2019 Stamp Duty Exemption For Instrument Of Transfer Loan Document Minimum 10 Discount

Intraday Traders Most Affected By Stamp Duty Hike The Edge Markets

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

Solved 7 Facai Sdn Bhd A Manufacturing Company Incurred Chegg Com

Review Budget 2020 Stamp Duty Real Property Gain Tax Ecovis Malaysia

Review Budget 2020 Stamp Duty Real Property Gain Tax Ecovis Malaysia

Loan Compression Forbidden Secret In Property Investing

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Comments

Post a Comment